Sweep Account Interest Rates: Your Guide to Smarter Savings

Want to make your spare cash work harder? Cash sweep accounts might be the answer. These accounts automatically transfer your uninvested funds into interest-bearing accounts, maximizing your returns on idle cash. This guide compares offerings from Charles Schwab and Vanguard, while acknowledging data limitations. We'll explore crucial factors for choosing an account, including interest rates, fees, and accessibility, and point you to additional resources for a comprehensive comparison.

What Exactly Are Cash Sweep Accounts?

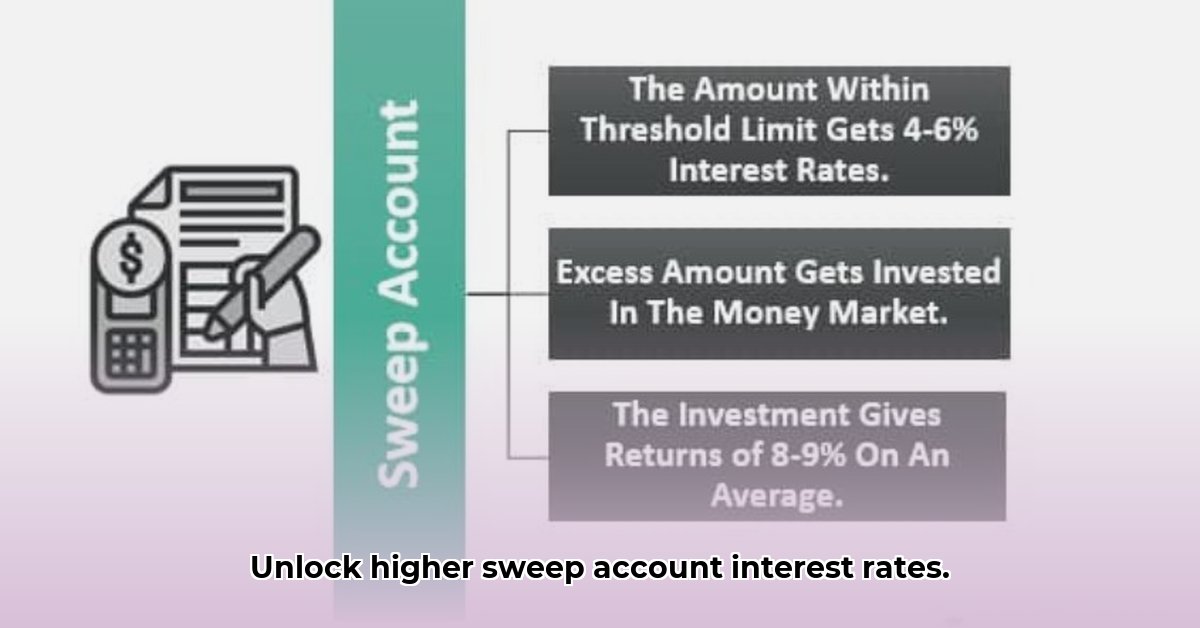

Cash sweep accounts are automated systems that transfer excess funds from your checking or brokerage account into higher-yielding investments, such as money market funds. This lets your money grow faster than a traditional savings account. Different institutions provide variations of this service, offering various features and benefits.

Finding the Best Sweep Account: Key Considerations

Choosing the right cash sweep account requires careful evaluation. Here's what to look for:

- Annual Percentage Yield (APY): The APY represents the actual annual return, considering the effect of compounding interest. A higher APY equates to greater earnings.

- Fees: Be aware of potential fees, including monthly maintenance fees, minimum balance penalties, and transaction charges. These can greatly reduce your overall return.

- Minimum Balance Requirements: Many accounts have minimum balance requirements to maintain the account or earn interest. Check if these requirements are manageable for your financial situation. A high minimum might not suit everyone.

- Accessibility: How easily can you access your money? Consider the speed and methods for transferring funds. Immediate access is ideal for emergency funds.

- Security Features: Prioritize security. Choose a reputable institution with strong security measures to protect your funds. Look for FDIC insurance (where applicable) for added protection.

- Integration: How seamlessly does the account integrate with your other financial accounts and platforms? Good integration simplifies your financial management.

Schwab and Vanguard: A Limited Comparison

Charles Schwab and Vanguard are prominent players offering cash sweep accounts, promising a degree of security and stability. However, detailed public information on their exact interest rates, fees, and specific account features is limited. This makes a direct comparison challenging. We recommend visiting their respective websites for the most up-to-date information. Their offerings likely cater to different customer needs and preferences.

Exploring Other Fintech Options

Numerous fintech companies offer competitive cash sweep accounts. Don't limit your search to the big players. Independent financial review websites and online comparison tools provide more comprehensive data, allowing for thorough comparisons across multiple providers.

Regulatory Considerations and Risk Management

All reputable financial institutions offering sweep accounts comply with relevant banking regulations, offering a level of consumer protection. However, understand these potential risks:

- Interest Rate Risk: Interest rates can fluctuate, affecting your returns. While generally higher than savings accounts, APYs are subject to market changes.

- Regulatory Risk: Changes in banking regulations can impact account features or access.

- Reputational Risk: The financial health and reputation of the provider directly affect your funds' security.

- Liquidity Risk: Although typically low, access to your funds may vary depending on the institution and the specific account type.

Actionable Steps for Maximizing Your Returns

- Conduct Thorough Research: Carefully investigate various providers and their offerings. Compare features instead of solely focusing on the interest rate.

- Utilize Online Comparison Tools: Leverage online tools to compare APYs, fees, minimum balance requirements, and other key features across different providers.

- Review Terms and Conditions: Scrutinize all terms and conditions, paying close attention to fees, minimum balances, and access restrictions.

- Make an Informed Decision: Based on your financial situation, needs, and risk tolerance, choose the account that best aligns with your goals.

- Monitor Account Performance: Regularly monitor your account's performance and consider switching providers if a better option arises.

By diligently researching and comparing available options, you can effectively utilize cash sweep accounts to enhance your savings. Remember to tailor your choice to your unique circumstances and financial objectives.

Key Takeaways:

- Cash sweep accounts offer an easy way to earn interest on uninvested funds.

- Comparing APYs, fees, and accessibility is crucial when selecting an account.

- Understanding potential risks, such as interest rate fluctuations, is essential for informed decision-making.

- Reputable, regulated institutions provide greater security and peace of mind.